On Wednesday, May 1 from 11 a.m. to 1 p.m. in the UC Commons (Forest Grove Campus), we will have three local coffee roasters tabling so you can taste their coffee. You will be able to vote on your favorite to help us determine which one will be proudly brewed in our new coffee shop and across our campuses!

News, Media and Stories

Did you know employees can bestow a family member's diploma on stage during May’s Commencement ceremony? Simply contact Rebeka Andrade in the President’s

Office and attend a rehearsal.

Discover your path to success at the MBA Open House on May 2. Gain insights from students pursuing dual degrees and those transitioning directly to the MBA program.

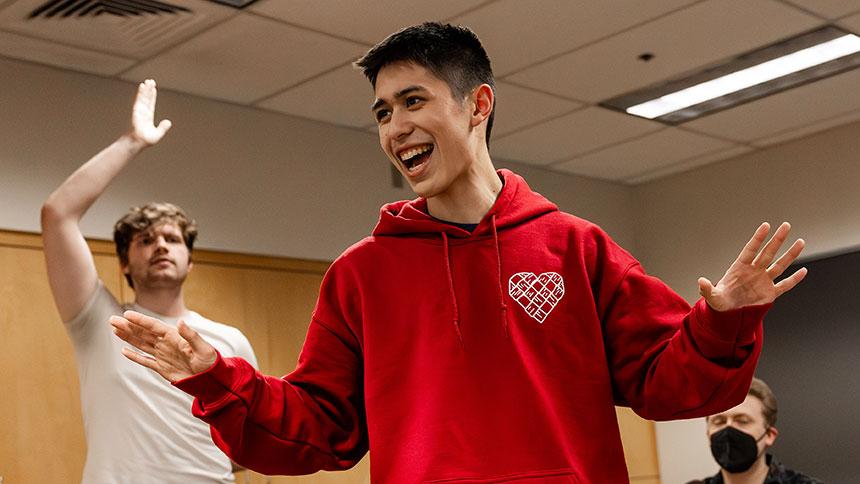

The inclusion of a five-song set of Hawaiian music in Noah Yamashiro's '24 senior recital was a homage to a culture that has had a large influence on his musical journey.

Pacific’s 2024 May Commencement is almost here! Join your colleagues on Saturday, May 18, and help with student support, guest seating, program distribution, shuttle driving, and more. Complete the registration form and select the time that works best for you, the 9 a.m. undergraduate student ceremony and/or the 1:30 p.m. graduate & professional student ceremony.

Pacific University recently conducted lockdown drills on the Hillsboro and Forest Grove campuses. Please provide your feedback and recommendations for future drills by participating in the lockdown drill surveys.

Student supervisors, will your students continue to work over summer break? If yes, you must fill out a Summer Student Employment Google form to ensure the student's information is kept in Paycom over the summer break.

The Indigenous Student Alliance will host Pacific's first Reconciliation Powwow on May 4 in Stoller Gym. Doors open at noon, and the first Grand Entry begins at 1 p.m.

Staff Senate is curating a day filled with motivational, team-oriented activities and opportunities to make new connections and get to know colleagues better.